Secure Your Funds With a Straight Cash Advance - Easy Application, Rapid Dispensation

With an easy application procedure and swift fund dispensation, these financings supply a fast means to secure your financial resources in times of unanticipated expenditures. Before diving into the details of just how straight payday finances can be a sensible alternative, it is crucial to comprehend the nuances of this economic device and exactly how it can be used successfully to navigate through economic unpredictabilities.

Benefits of Direct Cash Advance Fundings

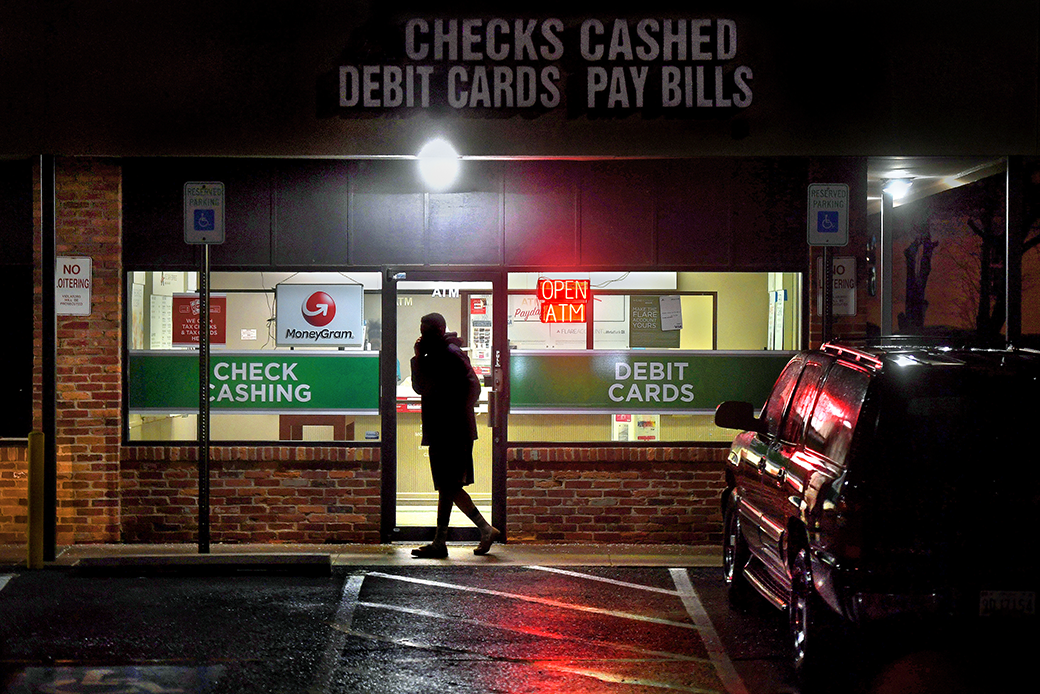

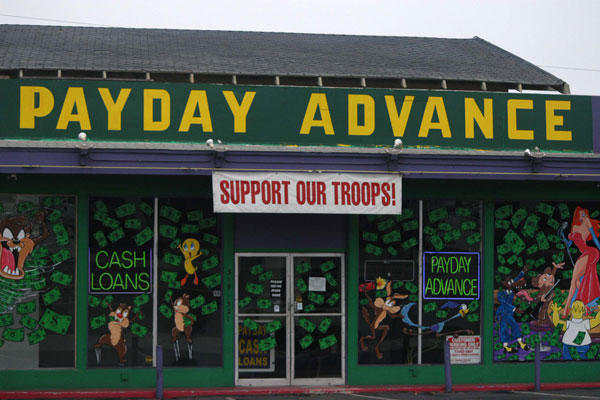

Direct payday advance offer a hassle-free and reliable method for individuals to gain access to quick money in times of monetary requirement. One considerable benefit of direct payday finances is the speed at which funds can be obtained. Typical bank financings commonly include prolonged application processes and waiting periods. On the other hand, straight payday advance loan usually have marginal documentation needs and quick authorization times, enabling consumers to safeguard funds swiftly, in some cases within the very same day of application.

In addition, straight cash advance loans provide flexibility in terms of usage. Debtors can use the funds for numerous purposes, such as covering unanticipated costs, medical costs, automobile fixings, and even consolidating financial debt. This flexibility gives people with the liberty to resolve their instant monetary concerns without restrictions on how the funds need to be spent.

Furthermore, straight cash advance are available to individuals with differing credit rating. While traditional lenders may require an excellent credit score background for finance authorization, payday lending institutions typically consider other aspects, such as earnings and work condition, making these loans a lot more comprehensive for people that might have less-than-perfect credit.

Application Refine Simplified

Enhancing the procedure for getting cash advance financings can considerably enhance the general individual experience and effectiveness of obtaining financial assistance. To streamline the application process, direct payday advance loan companies have accepted on-line systems, making it possible for borrowers to finish the entire application from the convenience of their homes. The digital application are developed to be simple, needing vital details such as individual information, employment condition, income, and banking info.

Moreover, to speed up the procedure, many direct cash advance lending institutions use fast authorization decisions, frequently within minutes of obtaining the application. This quick turnaround time is important for individuals encountering urgent economic requirements. Additionally, the streamlined application process reduces the requirement for substantial paperwork and paperwork typically related to financial institution finances.

Fast Fund Dispensation

With the simplified application process in area, direct payday advance service providers promptly disburse authorized funds to consumers in requirement of immediate monetary aid. When a consumer's application is accepted, the funds are normally paid out within the very same service day, supplying a quick service to urgent economic requirements. This rapid fund dispensation sets direct payday advance loan in addition to traditional bank financings, where the authorization and funding procedure can take several days or perhaps weeks.

In addition, the fast fund dispensation feature of direct payday advance makes them a feasible option for people dealing with unanticipated expenses or economic emergencies. Whether it's a medical expense, cars and truck fixing, or any other immediate financial requirement, borrowers can depend on direct payday advance loan for fast access to the funds they need to address pressing problems.

Qualification Criteria Overview

When taking into consideration straight payday financings as an economic service,Guaranteeing conformity with details qualification needs is crucial. To receive a straight payday advance, candidates normally need to meet particular standards set by the lender. Usual qualification requirements consist of going to least 18 years old, having a constant income source, and possessing an energetic monitoring account. Lenders may additionally consider the candidate's credit report, although an inadequate credit report does not constantly invalidate a private from getting a cash advance.

Furthermore, some loan providers might call for consumers to supply proof of identity, such as a driver's certificate or state-issued ID, as well as evidence of income, such as pay stubs or bank declarations. Satisfying these eligibility requirements is vital to make certain a find this smooth application process and timely dispensation of funds. Prior to getting a straight cash advance funding, people ought to meticulously assess the specific eligibility requirements of the lending institution to figure out if they fulfill the essential requirements. By understanding and meeting these needs, customers can enhance their opportunities of authorization and safeguard the this link economic aid they require.

Responsible Borrowing Practices

Exercising monetary carefulness is crucial when taking part in borrowing tasks to guarantee lasting security and safety. Responsible loaning practices include a detailed assessment of one's economic circumstance prior to obtaining a straight payday advance. It is critical to borrow only what is essential and within one's means to pay off comfortably. Prioritize vital expenditures and emergencies over discretionary costs to avoid falling into a cycle of debt. Comprehending the conditions of the car loan arrangement is critical. payday loan places in my area. Know the rates of interest, costs, and settlement schedule to make informed monetary decisions.

Conclusion

In final thought, straight payday advance supply a reliable and practical service for individuals seeking quick monetary aid. By simplifying the application procedure and offering quick fund disbursement, these loans can help customers satisfy their immediate monetary demands. It is very important for consumers to adhere to liable borrowing methods to guarantee their financial stability over time.

Prior to diving into the information of exactly how straight payday loans can be a sensible choice, it is crucial to recognize the nuances of this financial tool and just how it can be made use of effectively to browse through financial uncertainties.

Direct cash advance car loans supply a efficient and convenient way this page for individuals to access quick money in times of economic need.With the streamlined application procedure in area, straight cash advance funding service providers swiftly pay out approved funds to borrowers in requirement of immediate monetary support.Making sure conformity with certain qualification demands is critical when thinking about straight payday finances as an economic option.In final thought, straight cash advance fundings supply a practical and reliable service for people in demand of quick economic help.